FAQ: Business and Accounting

FAQ: Business and Accounting Program

What is the difference between business and accounting?

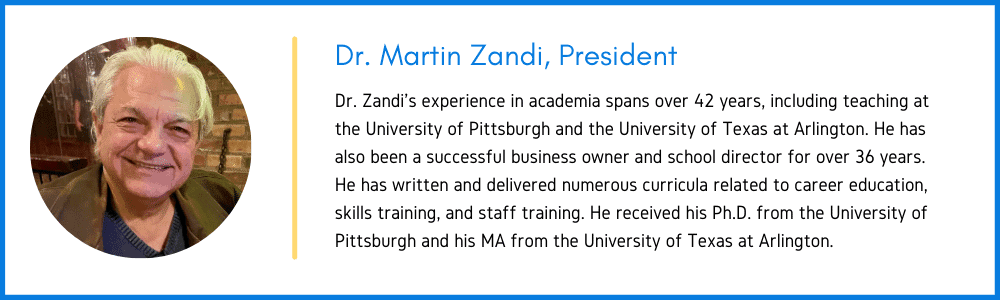

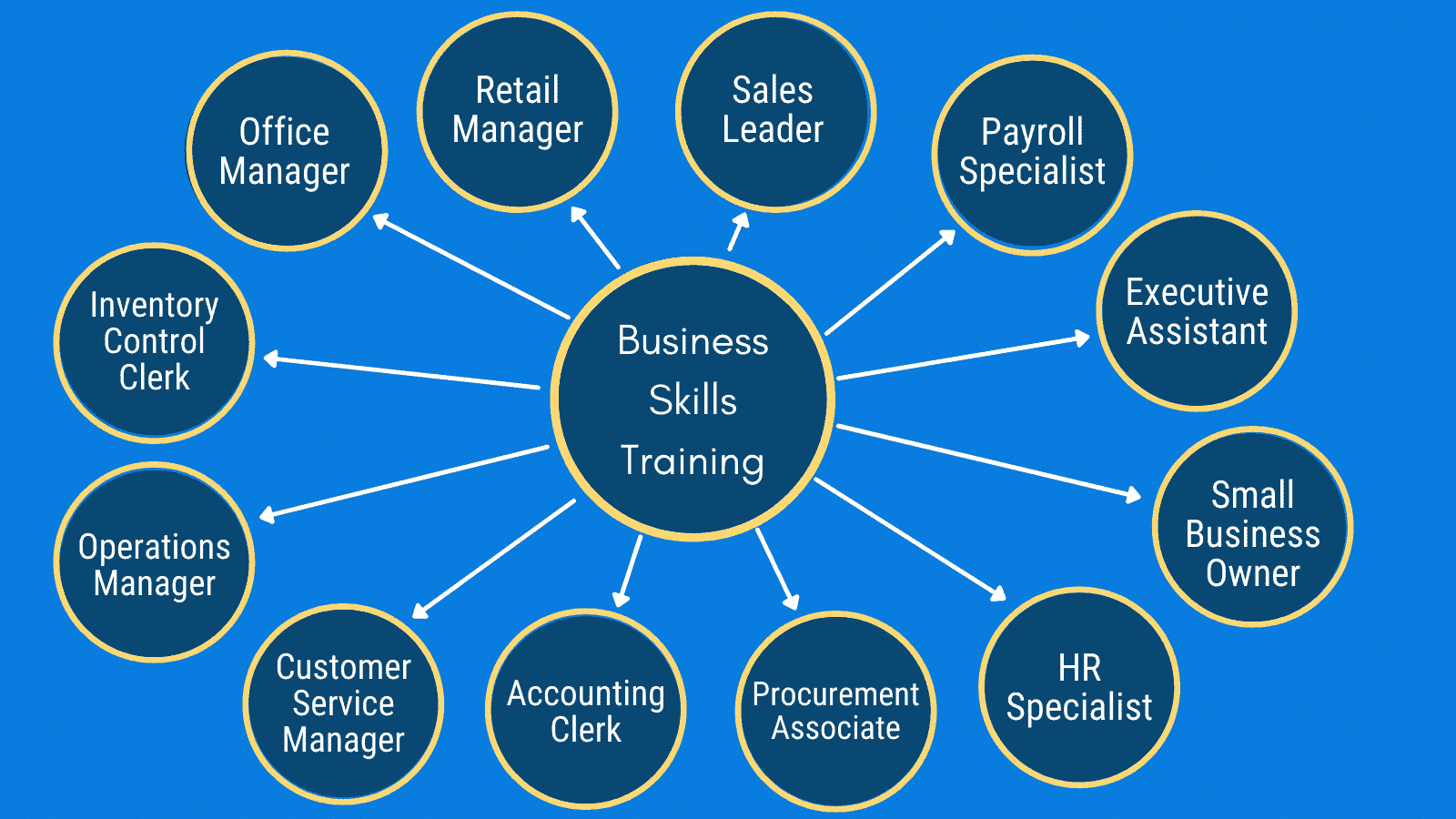

In CCI’s Business and Accounting Program, you will learn the basics of BOTH business and financial principles that will prepare you for a career in almost any organization.

On the business side of the program, you’ll cover skills such as business basics, ethics in business, customer service, and business functions/components.

On the accounting side, you’ll develop skills in business finance and financial document preparation.

Basically, business covers more general business basics, so you leave with basic knowledge on how an organization is set up and how it operates. Accounting is more specialized because it covers financial topics and prepares you to take on financial responsibilities in your new job role.

Even for positions that don’t require specific financial skills, the Business and Accounting program provides you with an understanding of business financial principles, which makes you a more valuable asset to any organization, in any role.

What skills are learned in the business and accounting program?

How is accounting used in business?

What are the different types of business accounting?

There are three main types of business accounting you might encounter during your career: cost, managerial, and finance.

Cost accounting is when a company determines how much it costs to produce its products and/or services.

In managerial accounting, you’ll prepare financial documents for investors and management so that they can make appropriate business decisions.

Finally, in finance accounting, you’ll create financial statements for potential investors and other companies who’ve expressed interest in your organization.

There are other types of business accounting approaches you might encounter but these are the main ones you’ll find in almost every company.

What does accounting mean in business?

According to Xero’s website, business accounting is the systematic recording, analyzing, interpreting, and presenting financial information.

Accounting can be done by one person in a small business or by multiple groups in a bigger organization. Accountants help businesses, small and big, keep track of their financial spending. Without them, companies wouldn’t know if they are making the right financial moves or making a profit.

How do you learn small business accounting?

There are several ways to learn small business accounting such as online, in-person, or both. In addition, there are different ways to get certified in accounting like certificates, online programs, or traditional college degrees. CCI offers an accelerated Business and Accounting program that students can complete in as little as 28 weeks.

What is the best program for smallВ business accounting?

CCI teaches QuickBooks in its Business and Accounting program. Many businesses use this software to keep track of their expenditures and earnings. And, if you choose to learn with CCI, you’ll receive a QuickBooks certificate as part of the program.

How do you learn bookkeeping for small businesses?

Bookkeeping and accounting can sometimes be one and the same, they are very similar.

However, there is a subtle difference between accounting and bookkeeping. QuickBooks, which is part of the program curriculum, is one of the most popular small business accounting and bookkeeping software on the market. It helps organizations manage income and expenses, it can be used to invoice customers, pay bills and generate reports. An article on their website does a good job of explaining the differences between bookkeeping and accounting.